Industry Especial

The rebirth of industry

This last edition of 2021 of the “Industry Special” also marks a year of partnership between AIMO and Executive Mozambique. There are now six editions of a journey in the name of mapping what is produced in the country.

Cabo Delgado and Niassa are the last two provinces to be visited and reborn from years of lethargy caused by military instability and the pandemic. The renaissance comes at the hands of the gas projects, which, according to the guarantee given by Total Energies, will soon return in an investment of more than USD 25 billion, which could also catapult other industries, in a province where 87% of all business volume is carried out by micro and small companies.

Agriculture, based on eucalyptus and pine plantations, which also marks this reforestation, is where Niassa takes the path of development. There are already more than 2.4 million hectares, in an investment that already exceeds USD 43 million.

Pemba Bay and the Niassa Reserve, two flagships of geographically blessed provinces, drive the ever-surprising tourism industry.

The mapping under PRONAI, recently approved by the government and partners, including the private industrial sector, provides prospects for better days for these provinces, having as business cards: (i) the paper industry, in Lichinga;(ii) the Cuamba Industrial Park, with a strong agro-industrial component; (iii) the Afungi Petrochemical Industrial Park, with a strong fertilizer production component; and (iv) the Balama Industrial Park, which will be able to meet the needs of the national and regional markets with products such as pencils, batteries and solar panels.

We end this editorial, which marks the last edition of the year, with wishes for happy holidays and a 2022 better than what 2021 was.

For a dynamic, modern and competitive industry.

Osvaldo Faquir

Executive Director – AIMO (Associação Industrial de Moçambique)

Flash News

▶ South32 announces purchase of 25% of Mozal shares

Australian miner South32 Limited recently announced the acquisition of an additional 25% stake in the Mozal plant. The mining company bought the additional stake in the aluminum smelter for USD 250 million from Mitsubishi Corp Metals Holding. With this purchase, South32’s shares in the Mozal aluminum plant go up to just over 70%. This is a measure that will increase the foundry’s annual production by 15%.

▶ USD 800 million project package launched

The government, through the Ministry of Industry and Commerce and the Chinese company West International Holding Limited (WIH), have just signed a memorandum of understanding for the feasibility of a package of investment projects in the country, valued at around 800 million dollars, which aim at setting up cement and clinker industries, generating electricity and products derived from ecological glass.

▶ State pockets 15.5 billion meticais with mega-projects

In the first half of this year, the Mozambican government invested 15.5 billion meticais in tax revenue from mega-projects. According to data from the Ministry of Economy and Finance (MEF), referring to the State Budget Execution Report (REO), from January to June 2021, the contribution of mega-projects grew by 57.9% compared to the same period in 2020, the year in which the State pocketed 9.8 billion meticais. The oil exploration sector contributed the most in the period under review, having reached 7.4 billion meticais, against 4.2 billion meticais in the same period of the previous year.

▶ Government expects “firm proposals” for Vale’s coal mine

The Minister of Mineral Resources and Energy, Max Tonela, recently guaranteed that Vale’s divestment process is proceeding according to the established schedule.

Investors interested in buying the Brazilian company Vale’s coal concession in Tete province will present “firm proposals” by December, said Max Tonela.

Tonela said that the Government will then assess the companies’ potential and make a decision on compliance with Mozambican legislation on this type of transactions, with the Brazilian company’s disinvestment process in Mozambique due to be completed by 2022.

CABO DELGADO E NIASSA

AN INDUSTRY TO BE REBORN

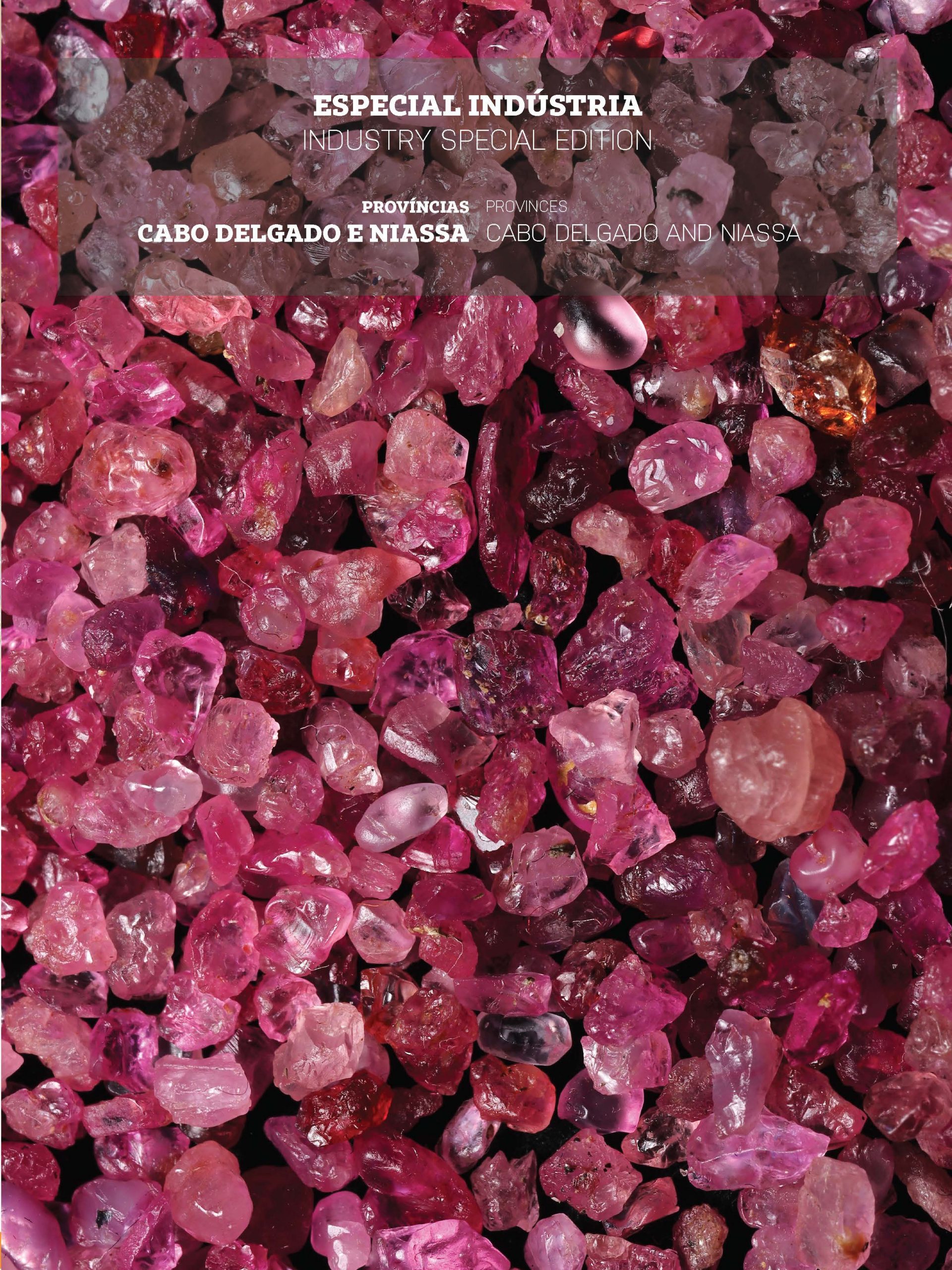

The natural gas exploration project in the Rovuma basin is so far the largest project in the province of Cabo Delgado. Then follow the projects of exploration of precious stones (rubies and gold) in the district of Montepuez and Balama.

In the last decade, Cabo Delgado is proud to have the largest investment project in the post-independence period, which is valued at around 25 billion dollars, by the French oil company Total Energies.

However, even though Cabo Delgado’s economy has been gaining some momentum in recent decades, the pandemic and military instability that have plagued the province over the past three years have compromised investments. The armed insurgency forced the stoppage of natural gas exploration activities in March of this year.

Data from the Confederation of Economic Associations (CTA) point to losses of USD 209 million and closure of 1,110 businesses due to the armed attacks.

According to data from the provincial department of Industry and Commerce of Cabo Delgado, 87% of all business volume in Cabo Delgado is carried out by micro and small companies.

The outbreak of the pandemic last year has not failed to cause damage either.

Montepuez Ruby Mining (MRM), a company that explores the ruby mine in the Montepuez district, south of Cabo Delgado, has seen its activities compromised.

“In 2020, as a result of the pandemic, MRM saw zero revenue. The mine was suspended from April 2020 to March 2021,” revealed the company when contacted by Índico, and then underlined that “luckily, we managed to get through without firing any worker, due to the financial support provided by the majority shareholder, Gemfields Limited, which holds 75% of MRM in partnership with Mwiriti, a Mozambican company, which holds 25%.”

Cabo Delgado has the third largest bay in the world, Pemba bay, accompanied by Wimbe beach and the islands of the Quirimbas archipelago as unavoidable hotspots. Therefore, the provincial directorate of culture and tourism of Cabo Delgado considers that there are many aspects that make the province a tourist reference. “We are the largest archipelago in the country, we have more than 32 islands, we have the first World Biosphere Reserve in the Quirimbas, and those who go there want to stay and never come back, because it is extremely beautiful,” points out the director of the department Iolanda Almeida, hoping that the latest developments to ensure safety can put the province back on the tourist track.

Niassa, with an area of 122,827 square kilometers, is a province rich in natural resources and with extensive fertile areas for agriculture.

In recent years, several international companies, but with minority stakes from Mozambican investors, have been attracted by Niassa’s high wood production potential. They are Chikweti Forests of Niassa, Companhia Florestal de Massangulo, Florestas de Niassa, Florestas do Planalto, Green Resources and New Forests which explore around 2.4 million hectares of eucalyptus and pine plantations.

These companies boosted the pace of the entire province, in particular Lichinga, the capital, where they opened many bank branches. To date, the six companies have invested a global amount of around USD 43 million in the province.

Tobacco cultivation is also noteworthy in Niassa. In 2020 alone, tobacco production yielded about 53.2 million meticais to producers.

Tobacco cultivation in this province, promoted by Moçambique Leaf Tobacco, is practiced in 16 districts.

According to the director of the District Service for Economic Activities in Metarica, notably the district where the crop is more predominant, Dário António, in recent years, tobacco production has increased significantly when compared to previous years.

“The revenue achieved by tobacco growers in Metarica during the process of marketing the production of the last agricultural campaign was around nine million meticais, against the 25.2 million estimated for the current season,” said the official.

Benefiting from an area of more than 6,000 km2 in Mozambican territory, Lake Niassa plays an important role in the province’s economy, in terms of tourism as well as fishing. It is estimated that there are around 6,000 fishermen divided into 165 fishing centres in Niassa.

The Niassa National Reserve stands out in itself. After all, it’s one of the last preserved wilderness areas in Africa.

Currently, the administration of the Niassa National Reserve, in partnership with the Wildlife Conservation Society, has a 10-year management plan (2019-2029) to better involve local populations in decision-making, as well as keeping the achievements in terms of preserving biodiversity and promoting the well-being and livelihoods of the 60,000 people living in the reserve.

Advertisement

CASE STUDY:

Ruby Mining: the gem that shines in Montepuez

Montepuez Ruby Mining (MRM) has been operating in the Mozambican market for 10 years, especially in the district of Montepuez, south of the province of Cabo Delgado. Its contribution has been very relevant to the province’s economy, making it one of the largest contributors to tax revenue.

Owned by the British Gemfields Limited, with 75% in the partnership with the Mozambican company Mwiriti, which holds 25%, MRM has been the number one contributor in the province of Cabo Delgado in every year from 2014 to 2019.

“Since the first ruby auction in 2014, MRM has sold a total of 13.6 million carats of rubies in the rough and generated USD 643 million in total revenue from 14 auctions (the most recentl completed in April 2021),” MRM’s management said to Índico.

In 2019, as a result of income from ruby auctions, the company managed to generate 122 million dollars. However, in 2020, due to the pandemic that forced the closure of activities in April, it closed the year without revenue.

“The mine was suspended from April 2020 to March 2021. The pandemic had a serious impact on Gemfields’ ability to hold gemstone auctions in their regular format,” it concluded.

MRM is considered the largest ruby mine in the world, responsible for 60% of the world’s production.

DH Mining: a company that wants to boost the development of Niassa

Although Niassa province is on the path of development, new signs indicate that the province could see good economic results in the near future. The joy stems from the announcement of the start of graphite exploration activities by the Chinese company DH Mining Development Company.

Operating in the Nipepe district, the Chinese company plans to start in 2022 exploring and processing graphite for the international market. According to the local government, with the start of these activities, the province will undoubtedly be able to discover a new path of economic development that has been long overdue.

According to the official in charge of Mineral Resources and Energy in Niassa, Silvino Bonomar, the project, valued at USD 30 million, is already at an advanced stage. “The process of installing the mining equipment, building the warehouse and the graphite processing unit is now underway,” Bonomar said.

According to data provided by the government of Niassa, the graphite mine to which DH Mining Development Company is a concession holder holds more than five million tonnes. After the Moma mine, in Nampula province, this is the second graphite mine to be explored in the country.

Industry Especial | Download

0 Comments